ABOVE: Infamous GANN chart covers year(s) of combined technical work from Hurst to Gann and beyond. Students are still working and thinking on this one.

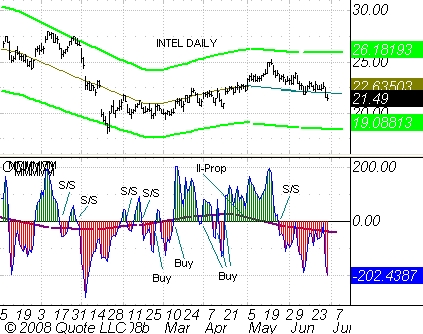

The II-Prop Index is the PRIMARY trend following device and the faster moving CCI Index gives buy and sell signals in the same direction until II-Prop changes trending.

STOPS are not used by myself but are suggested and are arbitrary based upon the risk assesments of the individual trader and the depth of drawn-down "deep pockets". Detailed analysis shows that once the general trend of the II Index begins to slow and reverse directional trend, no more signals should be acted upon until next cross-over occurs. Thus, cutting loss potential as one gets further away from initial buy/sell signals.

Contract/Share Size: Strongly suggest that size of positions be "in-"line" with Daily II-Prop..i..e. when II is NEG, the shorts would be 3:1 opposed to longs under same circumstances, especially in the case of SWING trading the S&P Futures.